Getting The Mortgage Appraisal Toronto To Work

Table of ContentsWhat Does Home Appraisal Brampton Do?Unknown Facts About Real Estate Appraisal MarkhamHow Real Estate Appraisal Brampton can Save You Time, Stress, and Money.The 2-Minute Rule for Mortgage Appraisal Markham3 Simple Techniques For Real Estate Appraisal MarkhamIndicators on Home Appraisal Brampton You Should Know

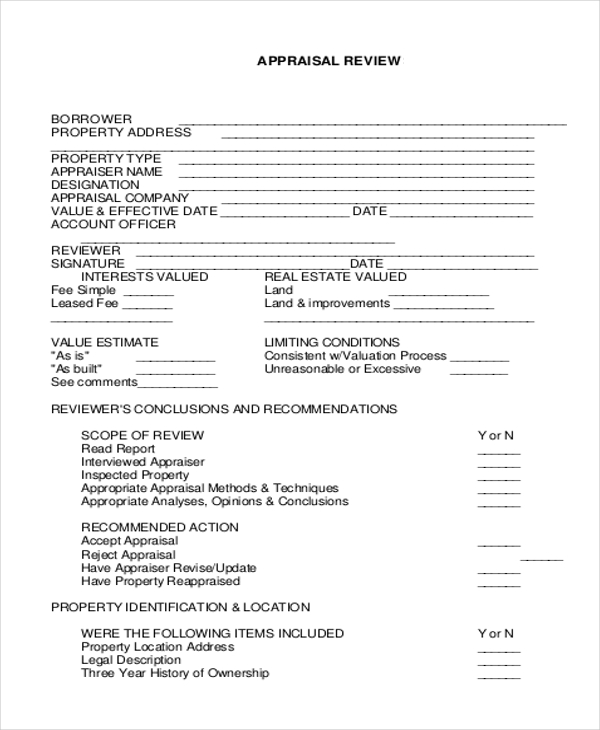

What Is an Assessment? An evaluation is a valuation of property, such as real estate, a service, collectible, or an antique, by the price quote of an accredited person. The licensed evaluator has to have a designation from a regulatory body governing the territory of the evaluator. Appraisals are usually made use of for insurance policy as well as taxes purposes or to identify a feasible selling rate for a product or residential or commercial property.The authorized appraiser should have a classification from a governing body governing the territory of the evaluator. Appraisals can be provided for several factors such as tax obligation objectives when valuing philanthropic donations. Home assessments can favorably or negatively influence the sale of a residence or property. Evaluations aid financial institutions and also various other lenders avoid losses on a car loan.

If a home assessment, for example, comes in listed below the amount of the acquisition rate, home mortgage loan providers are likely to decrease to money the deal.

The 7-Minute Rule for Mortgage Appraisal Brampton

Deductions can lower your tax obligations owed to the IRS by deducting the value of your donation from your taxable revenue. Appraisals can additionally be a valuable device in dealing with disputes between successors to an estate by developing the worth of the actual estate or individual building to be separated.

An assessment figures out the residence's value to ensure that the rate shows the home's condition, age, place, and also functions such as the number of restrooms. Appraisals assist financial institutions as well as lenders avoid lending even more cash to the customer than the residence is worth.

If the home remains in repossession, whereby the financial institution seizes your house, it needs to be marketed to help the lending institution redeem any kind of losses from making the mortgage. It is essential to bear in mind that when a financial institution lends for a home mortgage, it provides the total of the house's value to the seller on the day it's marketed.

An Unbiased View of Home Appraisal Markham

Because of this, the evaluation is necessary to the loaning procedure since it aids the bank avoid losses and protect itself against offering greater than it may be able to recuperate if the customer defaults. Keep in mind A home evaluation is separate from a residence evaluation, which is finished to figure out the condition of the residence as well as determine any possibly significant concerns prior to a customer relocates forward with closing.

Suggestion The actual amount you spend for a house evaluation can rely on where the home is situated as well as exactly how much time is needed to complete the appraisal. Home Appraisal Process and also Price The home evaluation procedure normally starts after a purchaser makes a deal on a house which deal is approved by the seller.

Getting My Home Appraisal Toronto To Work

Generally, a home appraisal for a single-family residential property runs between $300 as well as $450 while appraisals for multi-family homes can begin at around $500. As soon as the evaluation is gotten, the appraiser will schedule a time to go to the building. The evaluator will certainly after that conduct an extensive evaluation of the interior and exterior of the house to determine what it deserves.

A copy of this appraisal report is after that shared with the customer as well as the customer's home mortgage lender. If a customer disagrees with the appraisal record, they can request why not check here a reconsideration from the loan provider or choose to pay for a second appraisal.

Mortgage Appraisal Toronto Fundamentals Explained

The customer is most typically accountable for paying assessment costs at the time the assessment is purchased. A house appraisal is virtually constantly a need when purchasing a home with a home mortgage.

A purchaser might not call for an assessment if they're paying cash for a home versus taking out a mortgage car loan. Both purchasers as well as sellers can ask to be existing at the house appraisal with the approval of the evaluator.

What Occurs If the Evaluation Is Available In Too Low? If a house evaluation can be found in listed below what the customer has actually concurred to pay, there Read Full Article are a number of options they can select from. The initial is to ask the vendor to renegotiate the house's cost to ensure that it aligns with the house's appraisal value.

Real Estate Appraisal Markham - Truths

Do I Required an Assessment to Refinance a Home mortgage? Lenders use assessments to figure out a home's value for refinancing home mortgages the method they do for acquisition mortgages.